Oil: the ‘Putin Tax’ myth

September 2, 2022 6:54 pm Leave your thoughtsArticle by Mark Horner

President Biden coins the catchphrase, the ‘Putin Tax’ to blame President Putin for higher gasoline prices in the US while a non-analytical Western mainstream media propagates it.

However, the reality is that the price of oil and its derivative gasoline is influenced by a complex mix of dynamic price drivers, including macroeconomics, monetary policy and geopolitics. So, let’s test the claim that a ‘Putin Tax’ is the cause of higher oil prices.

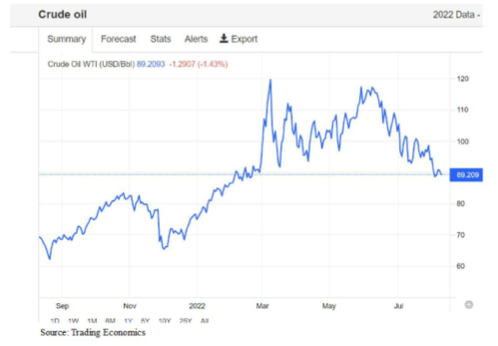

Our test focuses on the movement of the futures market’s pricing of West Texas Intermediate (WTI) oil or “crude oil” over the past year. We break the year in to three periods: (i) the movement for six months before the start of the Ukraine conflict (September 2021 to February 2022), (ii) the first month of the conflict (March 2022) and (iii) the following five months of the conflict (April 2022 to August 2022).

In the chart below, we first see that in the six months before the conflict the oil price is strongly trending upwards, rising by about 48% (from $60 to $89, per barrel). Second, the shock of the Ukraine conflict hits the market spiking the price by about 35% (from $89 to $120). And third, in the following five months the oil price fluctuates, yet it does not rise above its March peak and progressively falls to the price it was before the conflict ($89).

So, at first glance the chart tells us that whilst the Ukraine conflict elevates an already rising oil price its effect is transitory, unlike a ‘tax’. To explain the price movement, let’s briefly examine each of the periods.

Between September 2021 and February 2022, macroeconomics is the price driver where demand exceeds supply. With Western economies emerging from COVID lockdowns they seek more oil than the producers, facing ramp up and supply chain headwinds, can supply.

In March 2022, the macroeconomic driver is joined by the geopolitical driver of Russia’s military incursion in to Ukraine. News of the incursion rattles the futures market as animated Western leaders talk in inflammatory terms of Russia taking its first step towards invading the EU.

And the period between April 2022 and August 2022 is complex because Western monetary policy joins the mix of macroeconomic and geopolitical price drivers. The central banks shift to a hawkish monetary policy, reduce financial liquidity and increase interest rates.

The oil futures market reacts by factoring in to the price a recession and thereby anticipates a fall in demand. The quantum of the anticipated fall increases as China reaffirms the persistence of its COVID-driven economic slowdown.

Whereas on the price upside, a continuing tailwind is the inadvertent consequence of the West’s policy to sanction Russian oil (or 10% of global production) which introduces competition between Western consumers for oil that is not sanctioned.

And so, for the reasons above it is fair to claim that the socalled ‘Putin Tax’ is a myth!

An open question remains, however, and that is: will a recession in the West free up sufficient supply of oil to fill the shortfall stemming from the West’s circularity policy to sanction Russia by sanctioning itself?

Categorised in: Uncategorized

This post was written by LPJAdmin